The ongoing Pandemic has changed the way people buy products and retailers sell products. COVID 19 has reshaped the whole consumer marketing this 2020. Consumer goods manufacturers and retailers should ditch the old ways and get a new perspective about the entire operation.

As soon as the Pandemic hit, most people chose the online platform for purchasing the needs rather than risking to go out for essentials. This situation made most of the shoppers take their business to the web. Essentials mostly include hygiene-maintaining items and groceries. With this, we can assure you that the buying experience will not be the same as before.

The sales scenario in the market is completely changed; it is a sudden radical change. Covid-19 has given rise to many trends disrupting the industry. There is an increased surge in online marketing. The grocery penetration of e-commerce platforms has increased from 13 percent to 31 percent as people avoid going out and ordering everything using web apps.

However, it is even seen that those who went to stores found a different experience like maintaining physical distance, hygiene, mask usage, and significantly changed to Online shopping. Well, with these changes, if CPG companies want to survive in these situations, then they must nurture the capabilities and adopt new strategies.

In an analysis done by BCG, 40% of the consumers doing online shopping are first-timers. After restrictions easing-out, 35% of the consumers are still concerned and choosing an online platform to order essentials. It is predicted that by the end of the year 2022, the grocery category in the e-commerce platforms will be three times higher than the pre-COVID situation and two times higher than the pandemic forecast.

COVID-19 impact

Different CPG industries are facing varying disruptions to the demand and supply chain. Like the packaged food companies have seen a 54.2% increase in their sales in the Lockdown. On the other hand, royalty-based toys have reduced their sales due to postponed movie productions and sales.

The level of impact on the supply and demand of a few CPG industries are mentioned below:

- Home & personal care: Due to the Corona outbreak, consumers started stocking essentials. There is a high demand for sanitization products, especially the bigger package size. Due to a shortage of workforce and centralized sourcing, the production was interrupted while coming to supply.

- Food & beverages: Increased surge for online food and beverage orders. Majorly for dairy, ready to eat products, that too in bigger pack sizes. The supply of these demands was difficult as it raised sales required double the workforce and extra time for floor sanitization. Due to Lockdown, logistics delivery was also restricted.

- Beauty & cosmetics: There is an increased demand for safe beauty & cosmetics. Online consultation and e-commerce sales increased. However, there was a temporary disruption in the supply chain due to restricted transportations, increased manufacturing demand from a single area; sales to on-trade channels were also disrupted.

- Apparel & footwear: Steep decrease in consumer demand, as well as delay in new fashion launches, plus most of the people prioritized buying essentials than apparel & footwear. Due to Lockdown in major countries, the supply chain price increased, resulting in higher order cancellation.

According to a report from Deloitte, “Majority of the consumers are spending more on Convenience to meet all the requirements or their needs. Due to COVID-19, people are more likely citing contactless shopping, fulfillment on demand and easy inventory availability.” There are other key findings of the report as such :

- As of April 2020, the year on year growth of the eCommerce industry increased, and reached to 68%, surpassing the previous 40% of the total sales. With the ongoing pandemic, and countries following strict guidelines it is expected to increase to 72%.

- Convenience will continue to be king of the Market, more than half of the people have shown their willingness to spend more on what they want.

- People now are more interested in private brands. Until 2019, only 40% were willing to pay for the same or private brands. Now during COVID 19, people being at home and more cautious about health and products they use, private label sales increased.

- There is increased spending on hygiene, groceries, other sustainable products, and organic stuff, in these pandemic months. These brands will continue to play a key role in the market.

Where is the CPG industry today?

Consumer-goods roles are huge during this COVID crisis, meeting the increased demands of consumers and protecting the vulnerable. This sudden change may or may not be permanent. However, there will be a significant fundamental shift in the pattern of buying.

In the initial days of covid, the priorities were clear for the CPG sector: the safety and health essentials, ensure a strong balance sheet and maintain the availability of essential products with a resilient supply chain. The CPG manufacturers who are ahead in their supply curve drove increased enterprise agility, adapted cross-functional collaboration channels, and adjusted in the current scenarios.

However, now the case might be changing with an increased level of uncertainty; as the restrictions are slowly removed, many nonessential retailers who were forced to shut are re-opening their businesses. While it is uncertain as the Pandemic is not entirely gone, it can potentially spread and impact the economy.

Another concern is the changed buying pattern, and increased buying concerns may be carried forward to the future. While the CPG companies are the least affected than any other industry such as retail- the hospitality and traveling industry is the most affected sector.

The edible industry, such as food and beverages where growth is monitored concerning population and income, is seeing increased demand. This results in a massive surge in pantry loading and delivery.

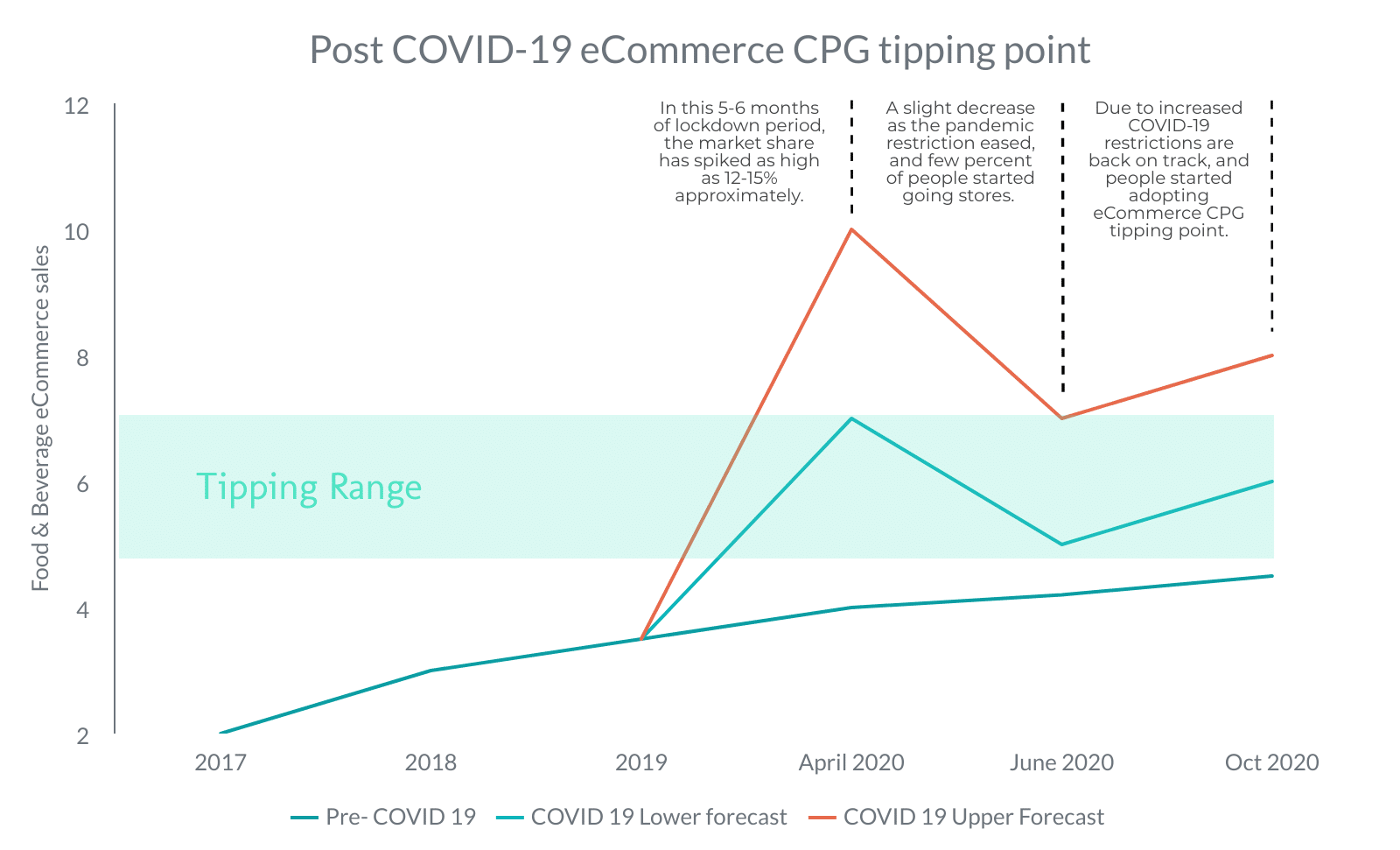

A historical change is seen! The food & beverage sector usually lagged in other categories such as apparel & footwear, beauty & cosmetics has seen a steep fall in their sales. In contrast, the demand for food & beverage has increased. Choosing the online platform for buying than going to shops has increased. The CPG manufacturers can work with the retailers and lower the cost-to-serve to maintain their operations.

It will take significant time for the consumers to shift from current frugality and embrace the older ways. But the heightened uncertainty will be there for some time. The retailers and on-premise places should try all possible ways to win back customers’ trust. In this Pandemic, people face a financial crunch, forcing them to shift to buy products at lower prices and save money.

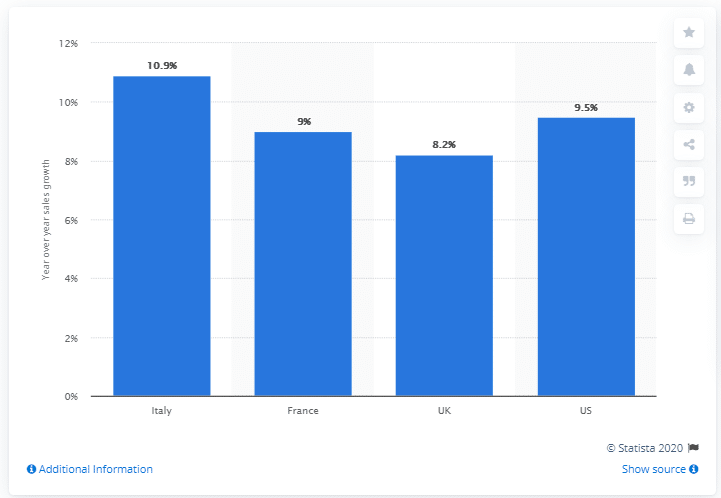

The ongoing pandemic has been a boon for the Consumer Packaged Goods industry. The demand for CPG increased from 10 percent to 12 percent in countries such as Italy, France, the UK, and the US.

Demand has also affected a lot and saw a market downfall, as consumption shifted from on-premise to home. It is likely to stay and persist. Most people are continuing to work at home, so companies have also taken a fresh look to strategize the workforce accordingly. It is better to change the plans according to the need of the hour and embrace new strategies.

Engage Consumers with CPG marketing

Ongoing Pandemic has increased the use of Digital Platforms by most of the Companies and customers. This situation has made the brands to look over and revise their marketing strategies to gain new opportunities and fulfill the changing consumer demand.

Some of the companies thought to take a dive and enter the direct-to-consumer market. For instance, a company launched a platform dedicated wholly to B2C. In contrast, most of the companies are still using the subscription order procedure.

However, some CPG manufacturers want to maximize their platform reach in the market and engage retailers to grab a significant share with an increased e-commerce demand. In this case, the retailers are enabled to:

- Placing orders online directly

- Avoid or reduce the stockouts by implementing the real-time inventory management

- Have the optimized SKU’s for digital channels

- Assessing new disruptive routes to market by partnering with a logistic and delivery business

There are many challenges, and the CPG companies should overcome all these to succeed in online sales. Entering into e-commerce and utilizing technology that will engage consumers by keeping a note of their preferences and priorities isn’t that easy.

Priorities the CPG industry should implement to survive now and post-pandemic

As most of the consumer’s shift to e-commerce channels, the sales of food and beverage categories will increase to 70% approximately by the year 2022. This will be the gain of CPG companies, who can develop effective omnichannel capabilities to maintain their position in the market. Simultaneously maintaining an interactive and innovative presence in the social channels.

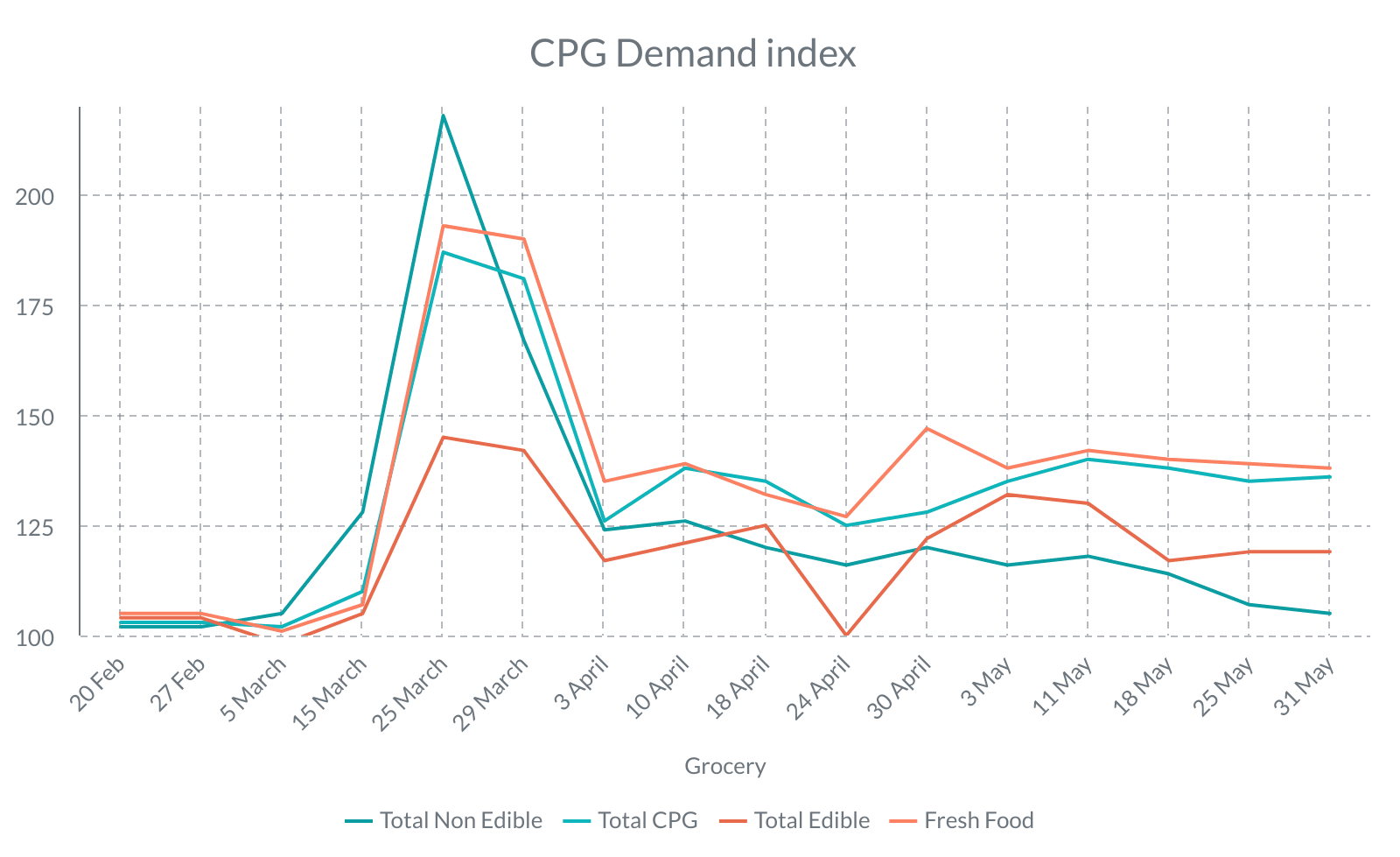

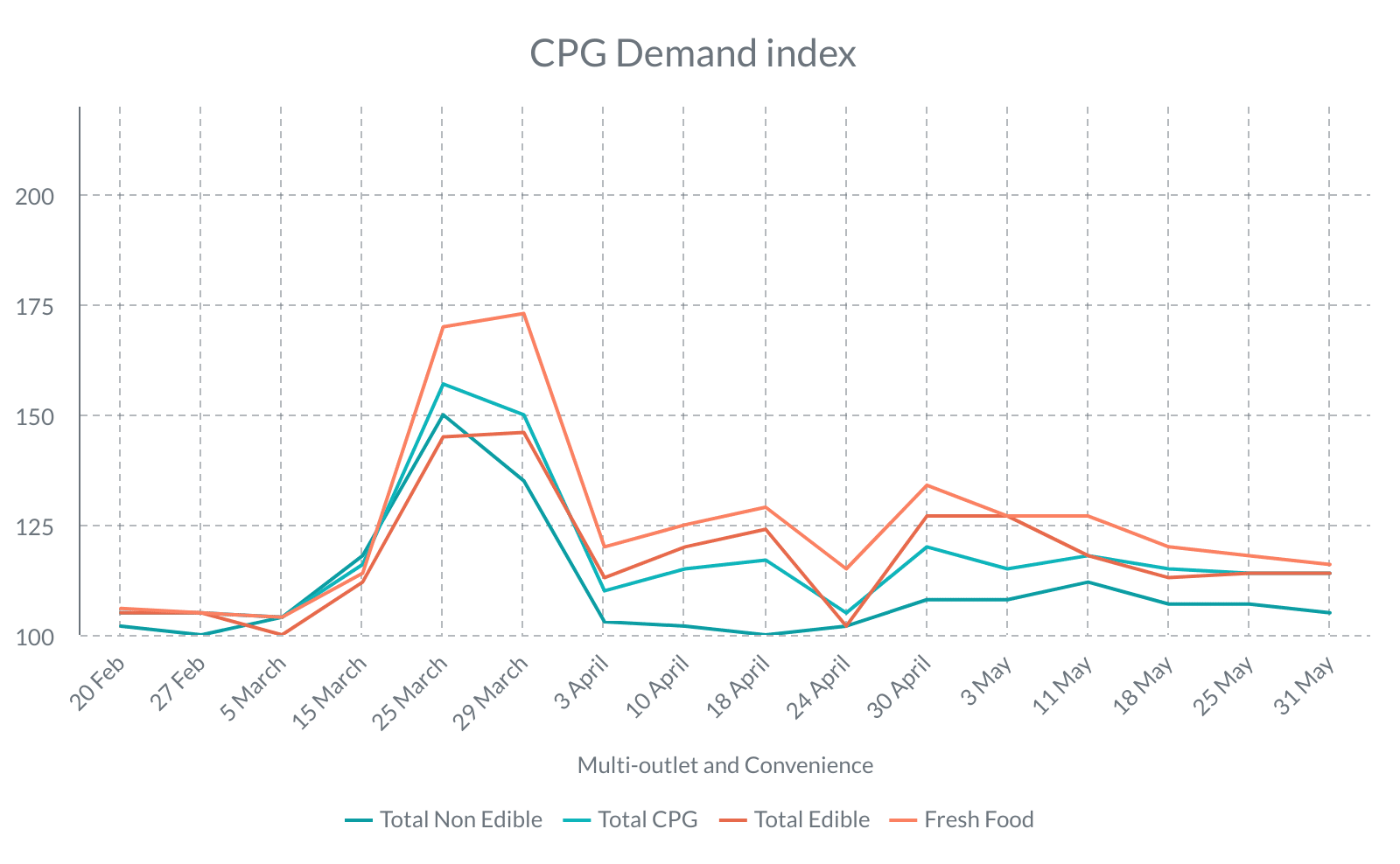

Below are the statistics showcasing increased CPG sales during the Lockdown. It is a representation of CPG sales by channels. The first one represents the increased sales of Grocery and the second graphic representation is for Multi-Outlet and Convenience. Amid this crisis, people are trying new brands, 50% of the consumers have tried new brands, however, 66% of them are likely to stick with these new brands.

As everything is turning from Pandemic to recovery, the CPG manufacturers must shift their focus to future plans. To make your mark in the market in such a situation, the below priorities should be focused on first.

Tailor all your capabilities to unique needs

As you will already have a standardized sales practice, it would be better to concentrate on approaching the consumers and targeting different channels and segments. This means customizing how to leverage data and other information to connect with retail consumers’ unique requirements. Analyze the collected data and check what the consumers want and also what they are interested in.

For instance, if a manufacturer wants to meet specific needs, they can reorganize its cross-functional sales team. For one retail consumer, there can be more data analytics experts in the team to facilitate the omnichannel strategy at work. However, there can be an addition of supply chain and operational experts for other retail customers, streamlining retail operations.

Making your sales model more flexible will help satisfy more customers and get a leading share in the market.

Partnership to improve omnichannel experience

Retailers have to serve hugely to customers in multiple channels; having a partner will help take care of the services, insights, and products. The job is not done just by moving in between stores, navigating mobiles, and e-commerce platforms. CPG companies should support the partner to do out-of-the-box things, grab people’s attention, and build even greater loyalty.

The consumer sales team should be clear about certain things before entering into it, such as, are they working the best with the online and in-store retail partners, is there another opportunity to increase it that they might have overlooked, are all the resource allocated in line with channel strategy, how to manage conflicts between retailers, e-commerce platforms and direct-to-consumer platforms. These are some important questions that must be analyzed before jumping in.

In an omnichannel experience, the more that data, the more accurate the result. A retailer knows what’s happening in his/ her region, while the manufacturers know how the products are performing in the market and different channels.

By having analyzed information, retailers can understand and optimize the omnichannel experience. If we take a step further, this analysis can innovate new ways to reach people.

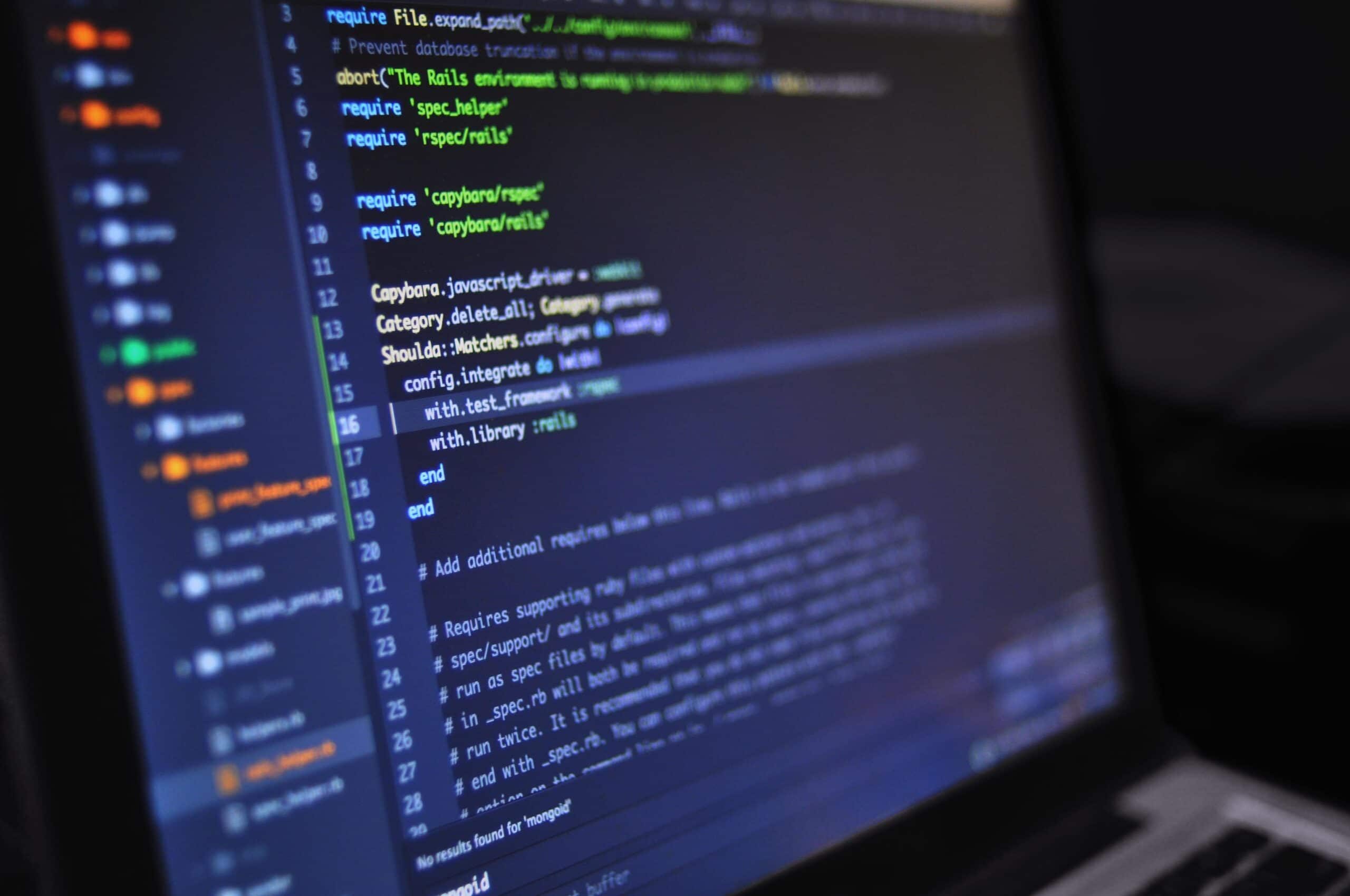

Increase efficiency with Digital Tools

Now we are in such an era where contactless buying is preferred. With the outbreak of Coronavirus, people prefer less risky or contactless buying. Prioritizing the online process and minimizing human contact to avoid infections.

This situation arose a digital wave, where every business is trying to be on the online platform, mostly the product selling companies. Most aspects, such as taking the order, delivery, and customer service, are digitized.

This crisis forced the consumer goods industries to minimize human contact in the production and delivery department. In the same way, it forced the retailers to reduce human connection in distribution to stores.

However, digitization came as a savior in this crisis period. The three digitization process that came in handy are:

- The route to market model digitization letting the customers know about your products,

- automation of all in-store activities,

- having advanced analytical experts by your side to get informed insights on shoppers’ patterns and product performance in the market.

The services such as telesales, messages, emails, e-commerce presence will, for sure, retain the market popularity of the product once the Pandemic passes.

Acting fast and adapting to an ever-changing market will always help the business. COVID-19 crisis has created a lot of challenges and changes in the market. It also discovered how important a retailer and manufacturer relation is.

In the Shutdown and panic buying situation, some recognized companies have stood still; well, on the other hand, few of the recognized brands are facing a steep fall in their sales. It all depends on how fast you grasp the changing market and shoppers’ interest and adapt to it.

The more resilient the company is, the less impact it has on its business. Simultaneously, it might take some time to wear-out the impact of COVID-19. This situation has reinforced the consumer-goods company’s values, providing the best chance to strengthen the retail partners’ marketplace.

Now it is time to be more analytical and plan to work uniquely and create increased value, presence, and engage people in their product.