How Blockchain technology can save the IRS?

Dating back to July 1, 1862, the IRS (Internal Revenue Service) stands flaunting 157 years of service collecting tax revenues from the taxpayers across the United States. From the age of no computers and no internet no blockchain to today’s digital age of existence, functional reforms have been inevitable. Over the years, the economy has witnessed several tax law reforms coming to effect.

The IRS is responsible for tax collection and Internal Revenue Code administration.

As per a report by Forbes, “the IRS plans to spend $291 million updating 140 computer systems to help it implement the new tax law.” The direct implication of the expenditure is the consumption of more than 90% of the funds allocated to the IRS by Congress.

Unfortunately, it is not exactly feasible for the nation to persistently afford such extravagance while trying to keep up with the technological changes.

The nascent emergence of blockchain technology carries the significant potential to reduce costs and thus save the IRS.

Blockchain Technology– Invention and Innovation

In 1991, two human figures on the face of Earth embarked on a journey to invent a digital record-keeping technology. Hence came forth the blockchain technology. But, the technology lingered beneath the carpets until 2008. It was only in 2008 that it found an application in the shape of cryptocurrency. From that day began the evolution of the blockchain technology.

While the years have witnessed an evolution of the technology, the concept continues to be an alien term for the masses.

What is blockchain, and how does it operate?

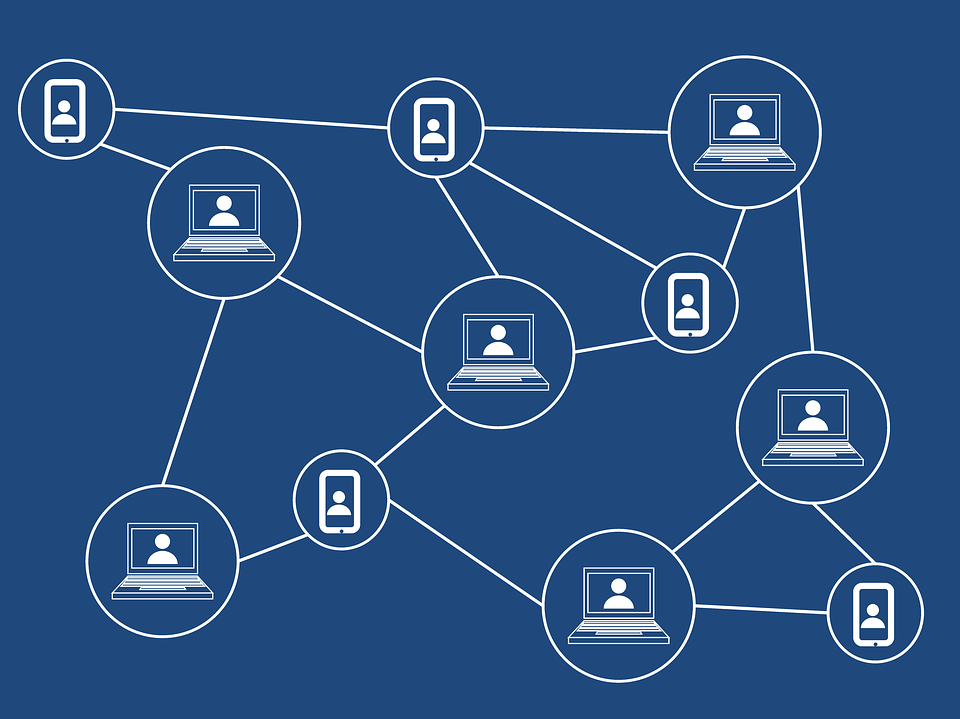

In layman terms, a blockchain is a chain of blocks that contains information.

It is a digital and distributed ledger (here, a shared record-keeping database) shared across all the computers in a network.

Each computer or device in a network is termed as a peer. Therein, all the peers share equal access to all the records across a database. This renders it as a Peer-to-Peer Network or P2P network.

While several peers constitute a blockchain, it does not use any central entity to manage the chain and blocks within. Hence, it is a decentralized network.

A blockchain has blocks linked to each other to form a chain. These blocks contain information. All the peers in the network individually verify any new piece of information added to an intersection. If it is found valid, the data is accepted into the chain as a part of the block.

Each block is assigned a hash code that uniquely identifies the block contents. Any attempts to change the contents within a block imply a direct change in the unique hash code.

The recovery of the chain would require a huge computational capacity. It would require a recalculation of the hashes for all the blocks. This, in turn, leads to the security and immutability of the stored information.

Smart Contract– An Output of Blockchain Evolution–

For long, blockchains have been in the phase of continual development. As a result of these developments, intelligent contracts have come into existence.

A Smart Contract is a form of blockchain that is responsible for storing contracts. They are quite similar to the already existing physical arrangements in the real world, except that they are programmed digitally.

Smart contracts inherit the immutability and distributive properties of a blockchain.

They contain programmed conditions which are self-executing. This eliminates the need for an intermediary from the contract execution process.

The elimination of an intermediary leads to the establishment of a trustless system. Both the parties place their trust in the fundamental blockchain system for the transaction/contract authenticity and implementation.

Blockchain and the IRS (Internal Revenue Service)–

Having discussed its operation, it does not come as a surprise that the adoption of blockchain technology is gradually gaining widespread momentum. The operating mechanism and principles of a blockchain furnish it with numerous core benefits of utilization. Each aspect of its functioning bestows it with a unique advantage.

The advent of blockchain into the realms of taxation can transform the ways of information storage, transaction settlement, IRS Offer in Compromise, etc. It offers benefits ranging from security to transparency; a blockchain is an ultimate savior for the IRS.

It would offer stimulation to the speed of transaction settlement, bring security, reduce costs, and hence deliver a much-needed efficiency and effectiveness into the system.

For example- When the IRS receives a mail check for a tax payment, it usually takes several days for settlement of the transaction. But the use of blockchains can bring an instant solution.

The use of self-executing smart contracts can significantly boost the speed of the tax collection process. These contracts help in making an immediate calculation of the tax liability via pre-defined computer programs. This facilitates revenue collection.

A real-time implementation of contracts takes place with the added advantage of complete transparency to the dealing parties.

Besides this, blockchain can have two variants- a private blockchain and a public blockchain. The IRS can adopt private blockchains to reduce the risk of identity theft. This allows the retention of the taxpayer data without compromising on security.

Another issue the IRS has been aching under is tax evasion. The use of blockchain technology can help avoid the fraud of taxes by real-time tracking of the funds. This lubricates the collection of taxes and loads the Government treasury with otherwise evaded funds.

The Future of Record Keeping–

The blockchain has come a long way seeking an informed presence in the modern world. Though it owes its initial recognition to the application in cryptocurrency, it now exists as an independent entity with many uses. Its uses carry the potential to remold the current methods of payment, storage, and settlement.

But, it still has a long way to go before acceptance into the taxation sector.

Despite offering various benefits, it is not bereft of limitations. The complexity of comprehension, the requirement of trained IT personnel, and the high amounts of power consumption are a few obstacles in the way.

The future would embrace the technology on the introduction and implementation of adequate amends. What lied in the background would come to the foreground and, its worldwide adoption would mark the beginning of a new era.

Sooner than later, the technology will find a place in and beyond the taxation sector. That would be a one-stop solution to the issues facing the Internal Revenue Service.

The world welcomes the IRS into its domain.