Majority of the economists in the United States are saying that the next Recession is coming. Unfortunately, all the signs are pointing towards the looming Recession 2020. We can expect that this time, the Financial Outbreak will be massive and also quoted as the “biggest so far.” If we check with the economists, the main reasons behind the Outbreak are “US-China Trade war” and “Inversion Yield Curve.” So, we can clearly, anticipate how the crisis would be, because marketing during the bankruptcy seems non-sensical.

What is a Recession?

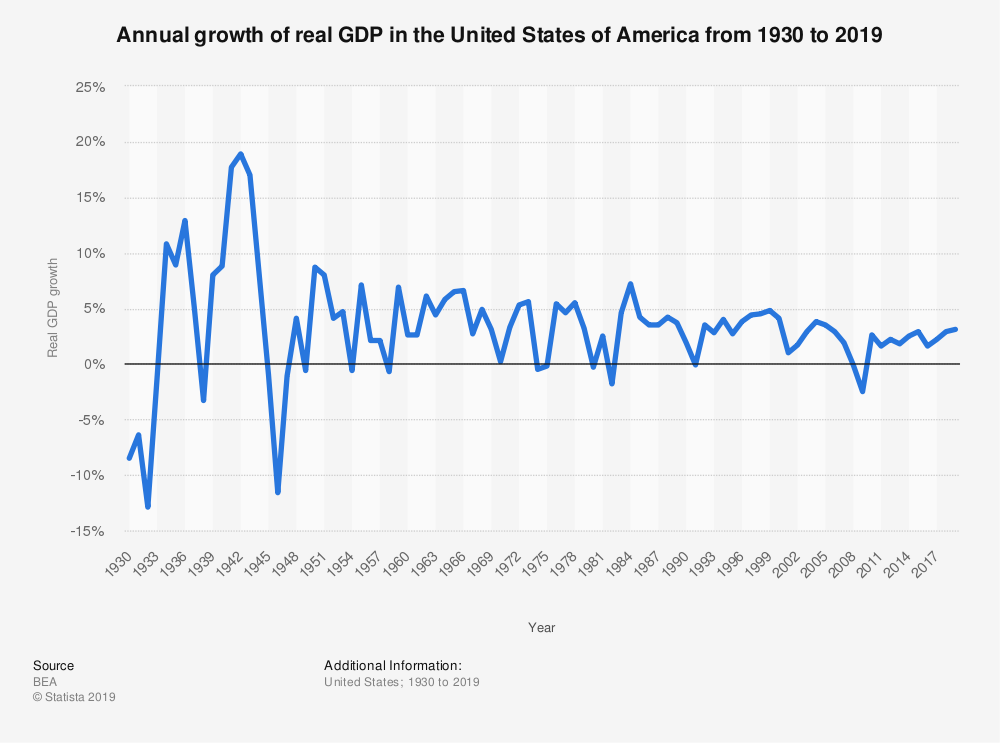

Generally, Recession is Financial Crisis when the GDP growth rate is negative for two consecutive quarters or more.

When there is a contraction in Business Cycle, generally there is a decline in economic activity. Slump usually occurs when there is a drop in spending. Typically, Slump is due to a lot of aspects such as the Financial Crisis, an external trade shock, or outburst of the economic bubble.

During this type of Financial Crisis, like Downturn, marketing agencies are the first ones to get affected. According to Forbes.com:

The furthermost reaction from most of the companies, during this Recession period is to cut, cut, cut everything, and the first one in the queue is always Advertising.

How do you know a recession is coming?

The two significant factors that tell about how we can know Crisis is coming, is mentioned below. Read the whole thing to understand better how economist reach to a conclusion regarding Slowdown.

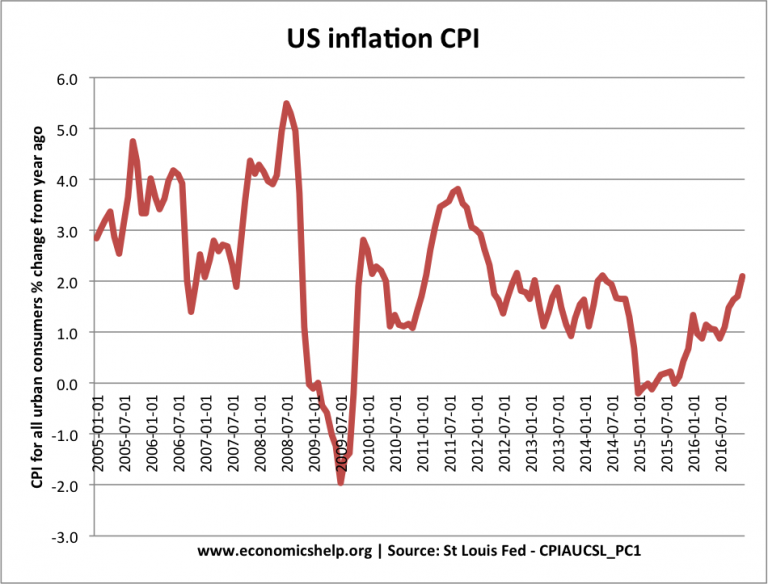

Yield Curve

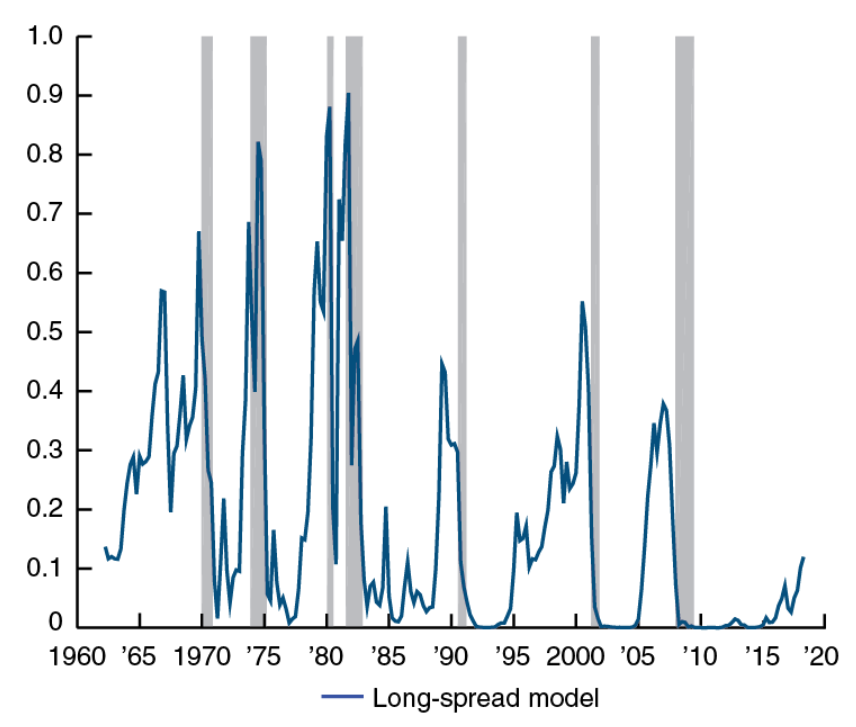

If you follow all the studies and forums about the Economic Outburst, then you will know that yield curve forecasts about the Trough. Since 1970 it has been seen that the slope in the yield curve becomes negative before every slump. It is called an “inversion” in the yield curve in this the short maturity rates, exceed the high maturity rates that lead to Great Contraction. The below graph showcase the ten to the two-year yield curve

Source: Chicagofed.org

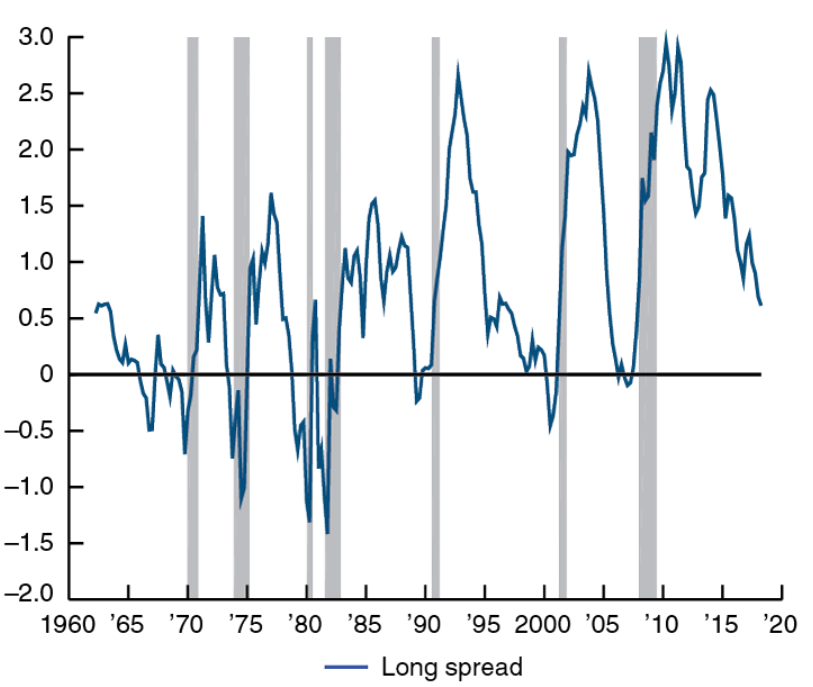

Yield Curve is usually, based on ten years treasury note just fell below the rate on the 3-month bond. It is the first time we’re are moving forward with limited data. All the Central Banks over the world are worried about this Great Financial Crisis. You can see the graph below, which showcase the estimated bankruptcy probability.

Source: Chicagofed.org

FED is trying to neglect the Outburn 2020 to maintain full employment. It is of the critical targets that everyone is looking for. The Alerting situations raised by monthly Yield Curve is making FED worry. As most of the banks invest majorly on treasury bonds, it is an alarming situation for Banks.

US Trade War with China

It is a known thing to the whole world, that how big competitors are US and China and behave as the Global Predominants rather than Partners. The raging trade war and currency war are the reflections of what these two countries are doing. However, the long term conflict indicates that the ceasefire will continue, as a result of this economy of both the countries will impact severely with no long term peace.

However, the Fed was sending signals that aim to pull back on the increase rate made in 2018, that include the concerns in the economic outlook that include Trade war with China.

Mr. Trump has recently blasted the Fed for not reducing interest rates. It is under the belief that the interest deduction will lead to more lending activities and will make the US dollar more competitive with foreign currencies.

According to Nouriel Roubini, a Prof. at NYU Stern School of Business predicts that:

The Global expansion will continue till next year, while the conditions will ripe for the next Global Recession 2020. The Global stimulus packages are coming to an end, inflation is coming, trade disputes will drag the economies by pulling down the interest rates.

For, both the US and China, it is essential that they should make peace and don’t escalate the war to the next level. To a point where there will be an unnatural end to all the supply chains.

When is a recession coming?

Most of the economists and surveys are predicting that by the mid of 2020 Outburst will start it is even predicted that it will have 38% impact on all the sectors, in later 2021 the outburst may have 34% impact. There is already a 2% decline in the manufacturing industry.

Will there be a recession in 2020?

As it is said, “better than you expect and worse than you even hoped.” However, according to the National Association of Business Economics (NABE) latest survey, which is based on 53 professional economic forecasters.

The consensus, clearly showcase that the economy has grown to 2.8% pace in the year 2018 while coming to 2019 the growth with come down to 2.6% pace growth, that will decrease even more in the next year 2020 and become 2.1% pace growth.

However, if we take US Presidential Elections into account, some of the marketers say that it will come before the Presidential Inauguration. During, this time the job growth will continue to be in brisk, with a decrease in average monthly increase, which is 184,000 in 2019 and it will be 139,000 in 2020.

On the other hand, the residential investment in 2020 will see a downfall to 1.3% from 2019 level. All these situations rightfully indicate that yes there will be a recession in 2020.

Only 2% of the 226 respondents will see the US recession this year, compared to 10% survey that showcased in February. There is the panel split to discuss whether the next Recession will hit 2020 or 2021.

Recession in US 2020

The first impact of the US Recession is Job loss. Not just in the US everywhere. During Credit Squeeze, there will provide no cashflow, and firms will be facing an economic crisis; Job loss becomes the primary issue. On February 2010 it was recorded that the US economy is shakier than that of Canada’s. Most of the service industries have reported the dropping in their market price value.

Between 2007 and 2009 there was a massive loss of the job, a total of 2.6 million people lost their jobs, the highest in 6 decades. The number is equal to the amount of the post found in the states such as Wisconsin.

A majority of the economist are saying that the next recession 2020 US will also be a part. However, according to the NABE recent survey, Donald Trump scratched out all the looming Credit Crunch in US news and stated that:

US is well prepared for all the situations. I don’t think we are having recession. we are doing tremendously well. Our Consumers are rich.”

Mr. Trump has recently given a massive tax cut, and he believes that people have saved and already have money.

According to Larry Kudlow, the chief economic advisor of President Trump:

Consumers are working at a very high wage. They are even, spending at a high rate. People are also saving money. So I think the second half, the economy is going to be good in 2019. I sure don’t see a recession.

Recession in India 2020 or मंदी

The Global economic decline in 2007 or मंदी started in December, the impact on India was enormous; the GDP growth slowed down to 9% in 2007-2008. After Wall Street collapsed in September 2008, the Indian GDP decreased to 5.8% and remained the same for the quarter.

In 2008, Indian high foreign exchanges reserve, prevented a lot of chaos, even after the foreign investors withdrew $12 billion from the stock market and foreign credit suddenly vanished.

During the Great Recession, according to the survey of Labour Bureau Ministry of Labour Employment: 500,000 people lost their jobs between 2007 to 2009 from eight primary industry, Information, and Technology, BPO, automobiles, gems, and jewelry, transportation, construction, and mining industry.

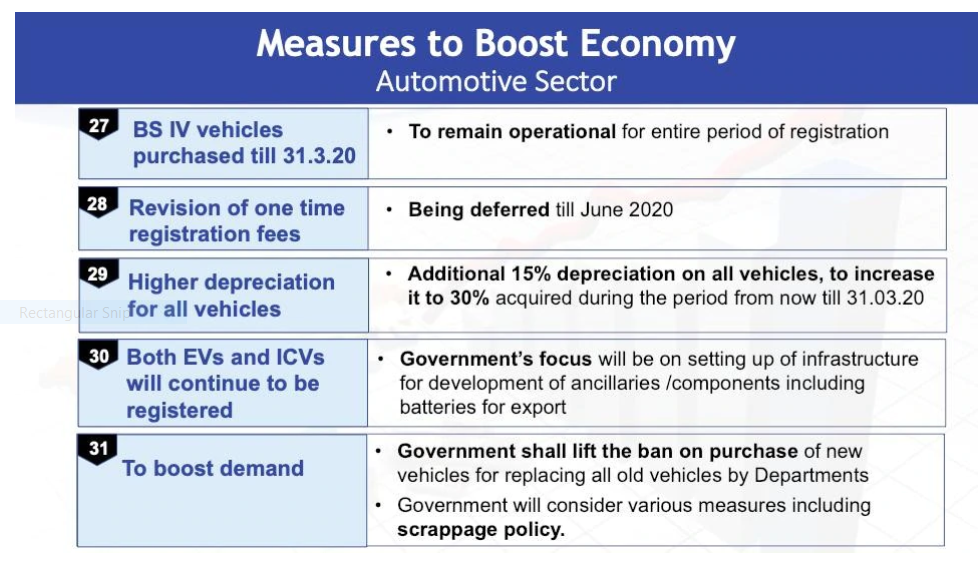

Source: Govt. of India

Nevertheless, there was a significant decline in the output of Automobiles, commercial vehicles, steel, textile, petrochemicals, constructions, real estates, finance, retail activity, and other sectors. Exports from India fell by 12% in October in Dollar terms.

For India, the Global Economic Crisis is coming, and the increasing trade war will lead to lessening external demand. All this could be heavy on our payment balancing, can damage the foreign financial outflow, and trigger exchange volatility.

According to Prof. Biswajit Dhar of JNU:

Indian exports that shrank down recently, is expected to remain affected as the trade barrier is hardened and their is the ongoing Trade war, all the countries around the world will try to protect their domestic exports.

Keeping trades aside, the oil exports will also be hampered. Given that US oil export from India has increased to 3 fold between November 2018 to May 2019.

The measure took for Indian Recession 2020

In a recent press conference with Indian Finance Minister Nirmala Sitharaman on 23rd Friday 2019, she slew all the safety measures that the Indian Government is taking. Regarding the steps FM Nirmala Sitharaman told

पूरी दुनिया के मुकाबले भारतीय अर्थव्यवस्था बेहतर है। निर्मला ने कहा कि आज अमेरिका और चीन जैसे देशों के मुकाबले भारतीय अर्थव्यवस्था कहीं ज्यादा बेहतर है।

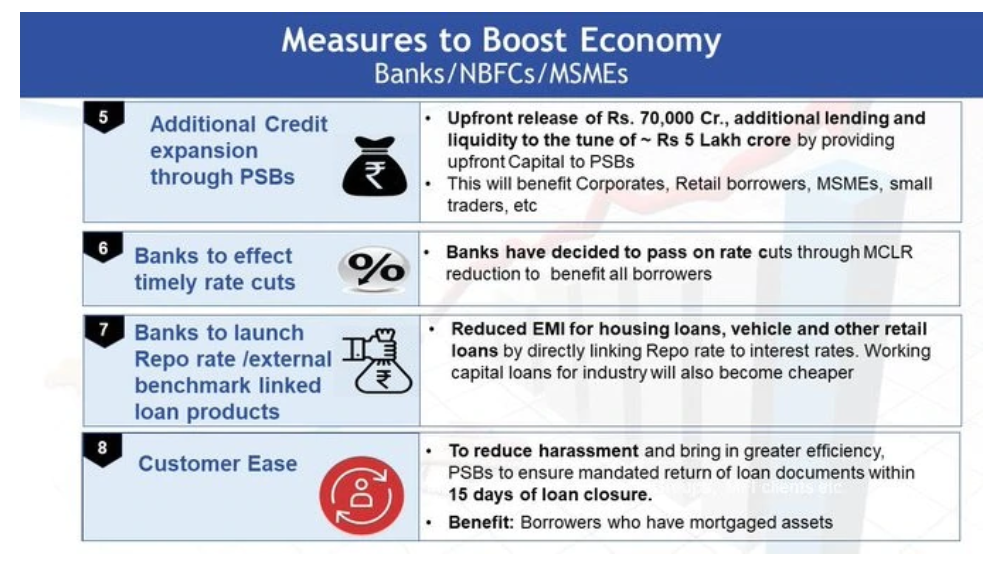

Adding to this, FM Nirmala Sitharaman explained about all the necessary steps; the Indian Government is seeking to overcome the situation.

- To boost the Auto sector: the govt has lifted the ban on govt bodies from replacing the old vehicles. The govt is asking to “Go and replace your old vehicles.”

- Rs 100 lakh crore is pumped for infrastructure. A task force has been assigned to expedite this investment, who will fund the money and monitoring every activity. Delayed payments will be on priority. Liquidity flow will be smoothened.

- The timely refund of GST for the MSME, all the pending refunds have already started and will be completed in 30 days. The future GST refund will be sorted in the next 60 days.

Source: Govt. of India

- The papers related Loan closure amount will be given in 15 days of the closure. Banks will improve the One Time loan Settlement (OTS), that will help MSME by implementing the checkbox system.

- RBI has directed all the banks to release the benefits of the Repo rates to the customers. The primary target of Government is to diminish the interest rates and auto rates.

- For the Banking sector, FM announced that:

“Government is releasing 70,000 crores, with additional lending of Rs 5 lakh by providing upfront capital to PSB” This will help strengthen MSME, retail borrowers, and traders.

- Government removes Angel Tax on Startups.

- Encouraging investment in Capital Market, it is even decided to withdraw the enhanced surcharge levied by the Finance No. 2 Act 2019. The pre-budget position is restored.

- Violation of CSR will no more be treated as a criminal offense and instead will remain as a liability. After 1st October 2019, income tax orders, tax, the summons will be issued through the centralized desktops.

This clearly, showcases that India has already taken all the significant steps to overcome Downturn or मंदी.

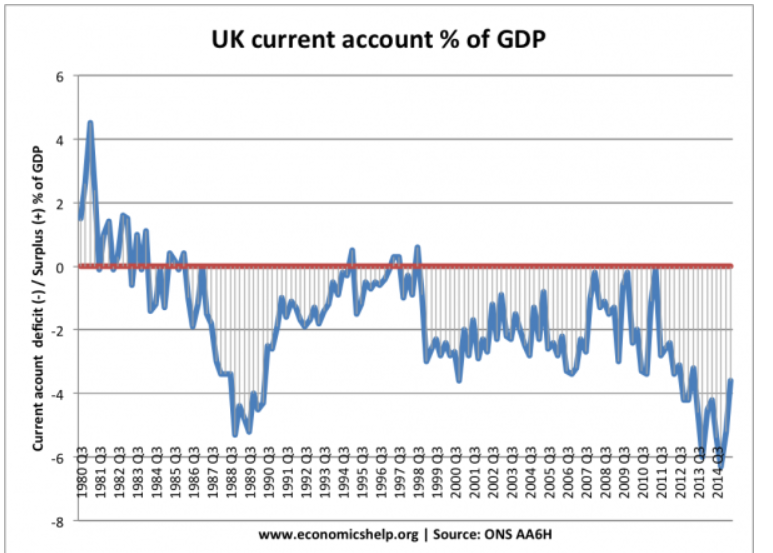

Recession in Europe 2020

Europe has more than 75% chances to fall in the upcoming Credit Crunch according to the lead economists. The Stock Markets in Europe extended their losing streak. The oil prices have fallen 3%, and the mounting Stagnation continues to hit the investors confidence.

In the last six months, the top 100 firms in Britain have dropped more than 1%. On the other hand, the stock market in continental Europe has dipped in response to the investors who are thinking to raise funds.

FTSE 100 ended this Thursday, and it dipped by 1.1%, at 7,067 lowest level since February. On the other hand, German Dax fell by 0.7%, and French 40 backed down by 0.3% dragging the European market to six months low. Later, in the coming days, it is evident that Europe will be facing a Huge Stagnation.

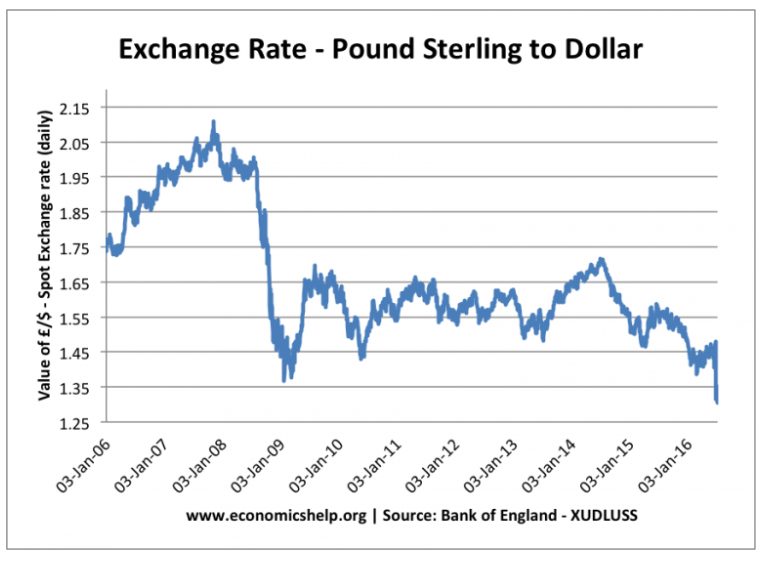

No-deal Brexit UK

There is an increased risk of no-deal Brexit in the UK, as it is clearly visible that the no-deal Brexit will push the UK into bankruptcy. According to Boris Johnson of NIESR (National Institute of Economic and Social Research)

There is one in four chances that the country is already in recession, growth has also been stalled for in the recent months, business investments have flatered and pounds has fallen sharply.

The economist believes that the UK economy has diminished in the last three months, making the first negative quarter in the first seven years. As a consequence of factory closure planned for potential disruption around 29 March the Original Brexit deadline.

The European Central Bank has cut down the interest rates further as a negative territory next month. Most of the major Central Banks that includes the Eurozone’s are free of politics have not engaged in outright manipulation.

All, these situations indicated, Europe will face a Great Economic Downturn, majorly affecting Germany, UK, Italy, Portugal.

How long do recessions last?

There is no specific period for the Credit Squeeze, if we check the records than the Last Great Contraction was on December 2007 to June 2009, one year six months, 5.1% decline in the GDP.

Recession 2020 is due from 4.5 years if we take in to account the United States business cycles, the average length of the growth economy is 38.7 months or 3.2 years. On an ordinary Credit Crunch lasts for 17.5 months or 1.5 years while the full business cycle on an average is 4.7 years.

The Longest Financial Crisis or the Contraction occurred in 1929, known to be the Great Economic Contraction in the United States that lasted for 43 months or 3.6 years. While the second slowdown is known as the “Great Recession” that we all experienced in 2007 lasted for 18 months or 1.5 years.

How lousy will recession 2020 be?

The three things to keep in mind which all are true: Most certainly the USA will not undergo Trough right now. Yes, the US may avoid one of the disastrous foreseeable future. But, the chances of the US to fall in this Trough is increasing every week.

Long term interest rates have plunged since the end of July- there is a shift which historically predicts that the lower interest rates are cut down from the Federal Reserve. It showcases an increased risk factor in the economy into outright contraction.

However, a lot of Financial marketers have been saying that there will be no Credit Crunch for the US in 2020. On the contrary, there are plenty of proves which directly indicate about the near Financial crisis.

Here comes the most important one, due to President Trump’s, On-Off execution with China leading to Trade war with this other countries have fed uncertainty with business decision making. On the other hand, the corporate investment is lessening, even though tax cut by Mr. Trump will boost the investment.

According to an economist Tara Sinclair, of George Washington University

Recession 2020 is a self-inflicted wound type, but how deep the cut will depend on many other categories of the economy thereafter on the policy response.

Now the economy in China and the other neighboring Asian Countries are getting weaker, which is giving rise to the Trade war with the United States. While the Europeans who are already in large ongoing debts will surely fall in Credit Crunch. Incase, Britain crashes out of the European Union with no current exit deals until October 31st, Europe will face even more profound challenges.

According to the survey of the Institute of Supply Management (ISM), in the United States, the growth rate has slowed down for a consecutive month, and July has the weakest reading. All these factors indicate us how bad the Recession 2020 would be.

What happens during a recession?

Effects of Recession are a lot; all of them related to the Financial Crisis, in this period, there is always as tremendous negative economic growth. You can see all the Financial similar thing to be falling apart. We listed out some of the significant changes that take place during this period, check it out:

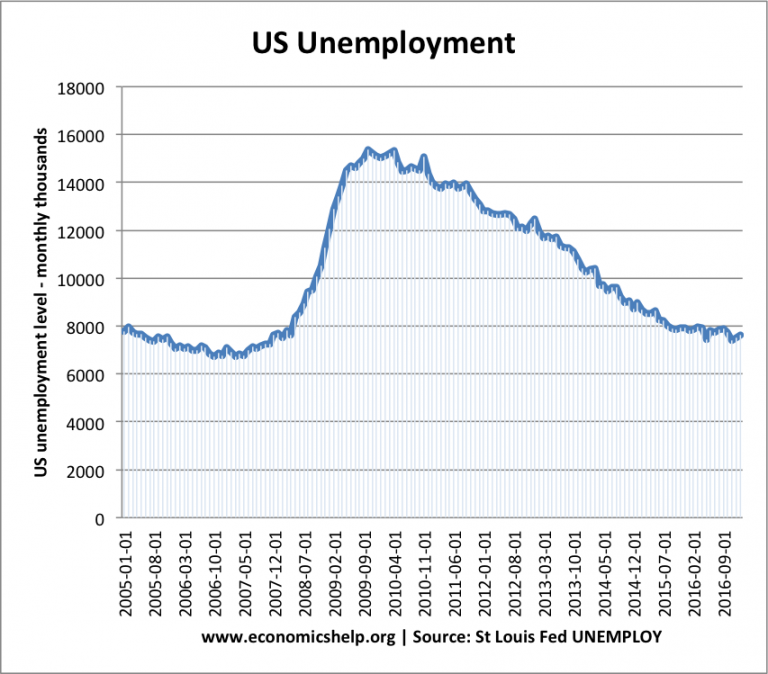

Unemployment

During the Financial Crisis, the firms produce very less, and therefore, they require very fewer employees. Nevertheless, some of the firms even go out of business during this period, causing the workers to lose their jobs.

If we take 2007-2009 trough into account, a lot of people lost their jobs who belonged to banking or finance sector. Simultaneously when the demand for the Cars fell, the workers were laid off.

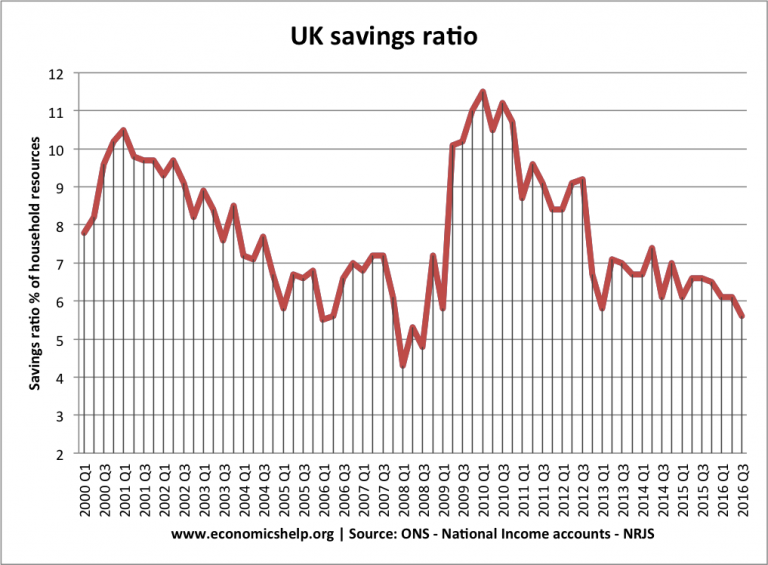

Saving Ratio Increases

During the Financial Crisis, people become careful and tend to save money as the market falls. If people have a fear of losing their jobs, then usually people don’t want to spend or lose the money they have and instead start saving more money.

If we consider the previous surveys, it is clear that during the Great Economic Contraction, there was a Paradox of Thrift- as people tend to save more and reduce consumption. This makes the Downturn even worse as it reduces the consumption rate. Individually, everyone is doing the right thing by keeping, but as everyone targets on saving, then on a total consumer spending decreases.

Fallen Interest Rates

In Stagnation, interest usually falls. This is all because inflation is lower and the Central Bank tries to stimulate the economy. Lower Interest rates, help the economy from striking the Stagnation.

Lower Interest rates usually decrease the cost of borrowing and encourage investing and consumer spending.

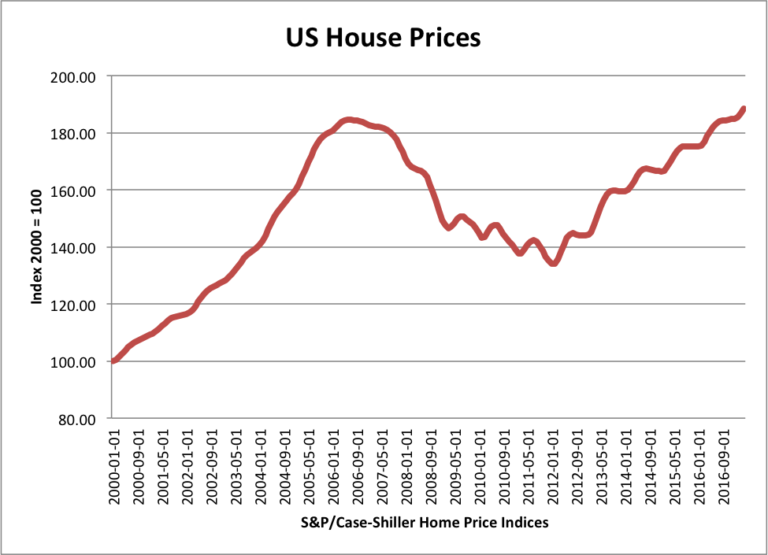

Fallen House Price

Usually, the House Price falls before Stagnation strikes, and this is one of the critical cause of Recession. During this time, unemployment increases, people don’t want to invest in housing as they can’t afford mortgages, so home repressions become common. This leads to an increase in housing availability and decreased demand for it. This is one of the primary reason for the 2009 Recession.

How can different Agency survive in a Recession?

The best and the safest way is to diversify your clients. In this way, your work will not be just entirely dependent on one client from one region. If you have client contraction problem, it is better to plan to grab more clients.

Surviving in Credit Squeeze is what each and every firm wants. To make it easy for all the readers, we have listed out some of the top hacks that you can use.

Build Cash Reserves for your Agency

If you are new to the market, usually, companies under the span for five years should have cash reserves at least for a year. This can a combination of business checking cash plus personal saving. Until your business gets a constant monthly cash flow, it is always better to have a Cash reserved for future use.

This is important for the people in all sector because once a Slump has started,

- Clients can slow down your payments, and even can cut-off the cash flow.

- In worse condition, one of your more prominent clients may be forced to sell his business.

Either way, cash reserves are significant, if are having a Digital Marketing, or an Advertising Agency, it is recommended to keep reserves for at least a year. Marketing fields are increasing day by day. It is always better to be on the safe side by keeping some reserves.

Even though Digital Marketing and Advertising Agencies are least affected, it is good to have reserves, as you will have time to grab some clients for the future growth of Digital Marketing, and SEO.

Controlling the Client Credits and Invoice Clarity

When we come down to transaction a lot of firms work based on net-30 days terms. This means you provide a service and wait for 30 days to receive the payment. However, if it is the Economic crisis, then 30 day period might look a bit difficult for all type of firms.

Reasons:

- Clients might ask to defer the payment with 60-days or 90-day payment

- Sometimes, clients may even go out of business, leaving you with hard work and cashflow.

The alternate way, here is to check your client’s commercial credit, and eventually prepare your self especially during the economic crisis. You can provide your Client with a Credit Proposal according to your withstanding.

Try to implement, a reliable system for invoice collection, that reduces the overdue payment issues.

Outsource Your Services

During the Trough time, it is best to outsource your services, than hiring new people. It will lower the labor cost that will strengthen the bottom line, they will provide some cash flow, and the agencies can allocate their resources to research and development.

Outsourcing is a viable plan during the Trough period.

Conclusion

If we look at all the points above, we can conclude that all the suitable, reasons are indicating that the Downturn can be a bad one, mostly for the Countries and businesses will be affected by it.

For all the job holders, it is better to have faith in their savings for a year. So even if there is a situation of jobless, then their saving will be the biggest saviors.

Even if the Government of the different countries says that they are good to go and can face the next Slump and there will cause no damage, however, we suggest that it is better to save some Cash Reserve that is suitable for at least a year.

If you have any further query regarding Slowdown, do feel free to write us, through email or comment below. We will surely help you!

I am happy to read your research report. It has widened my knowledge. Please keep me updated of your latest thinking in this vital issue.

Very great blog and knowlegeable. It gives insight about

Value Investing ideas and recession.